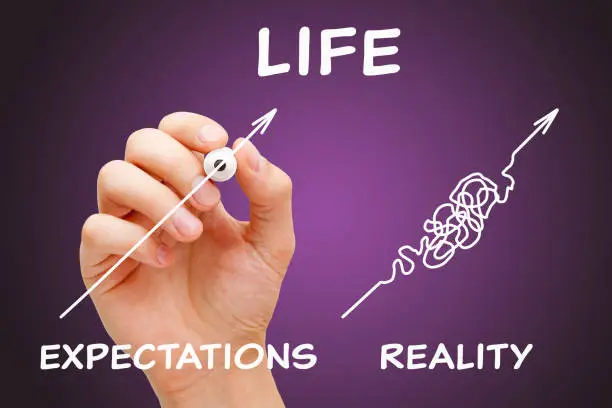

Hello Workster, do you remember that feeling the last time you landed a big client?

Felt like you were on cloud 9, right?

Then you sat there behind your computer screen, slipping into a daydream, imagining the steady income, potential for more work over the long term, and an opportunity to build your portfolio.

Okay, maybe you don’t feel this way when you land a big one but in a market where uncertainty is the order of the day, landing a big client may not be all sunshine and rainbows.

And I say this because relying heavily on one or a few major clients can present significant risks to the stability and growth of your business. Join me in today’s post as we explore the downsides of client dependence, and how to strategically diversify your client portfolio to protect your income, sustain growth, and secure a stronger position for the long term.

The Pitfalls of Client Dependence

Reliance on a small number of major clients may seem efficient (especially when these clients are in a similar niche), but it can be precarious. Here’s why:

- Financial Vulnerability

Think back to a few years ago, when GPTs from OpenAI and Claude made their way into the market, we saw this trend affect the content writing space, with many companies adopting AI into their content workflow and generation processes. This also saw some freelancers lose major clients, leaving them scrambling to find replacements and stabilize their cash flow. Having just one or a few clients accounting for the majority of your income means you’re at their mercy and any changes to their needs, budget cuts, or internal restructuring can directly impact your financial health.

- Increased Pressure to Meet Demands

When your income is tied closely to just one or two clients, there’s a risk of overcommitting to their projects or adjusting your own terms to keep them satisfied. This dynamic can lead to overworking, compromising on rates, or allowing scope creep, which impacts both profitability and quality of life.

- Restricted Growth Opportunities

Client dependence often leads to a limited focus on acquiring new clients, growing your business, or exploring new niches and skill sets. In the long term, this can narrow your experience, impact your versatility, and prevent you from building a more robust network. You may find that instead of a broad, sustainable client base, you’re stuck with a few clients whose needs dictate the scope of your skills.

- Reputation Risk

If you’re closely tied to just a few clients, any change in their reputation or market standing can affect you, too. For instance, if a primary client faces reputational issues, bankruptcy, or downsizing, your business can be indirectly impacted by association, lost work, or a reduction in income.

What Client Dependence Looks Like

To effectively address client dependence, it’s essential to recognize when it’s happening. So here are a few signs that you may be too dependent on one or a few clients:

– High Percentage of Income: If more than 50% of your revenue comes from one client, you’re highly dependent.

– Availability Dominated by One Client: If most of your time is consumed by work for one client, leaving little room for new work, it may be time to diversify.

– Infrequent New Client Outreach: If you’re rarely in pursuit of new clients or project opportunities, you may be overlooking growth potential.

How to Break Free: Diversifying Your Client Base

Breaking free from client dependence doesn’t mean cutting ties with your big clients. Instead, it’s about reducing risk and positioning your business to thrive, even when life throws a curveball. Here are actionable strategies to help you diversify your client portfolio:

- Set Client Revenue Caps

One way to control client dependence is to set a revenue cap for any one client. For instance, aim to limit each client’s contribution to no more than 30% of your total income. This forces you to spread your revenue across multiple clients and helps prevent any one client from holding too much influence over your finances.

- Expand Your Marketing Channels

Relying on word-of-mouth or a single lead source is limiting. By diversifying your marketing efforts, you can increase your visibility and chance of attracting new clients. Some ways to do this include:

– Strengthening Your Online Presence: Invest in a professional website, showcase testimonials, and maintain active social media profiles where you regularly share insights and case studies about your work.

– Utilizing Freelance Platforms: Platforms like Workstedi (if you do not have an account yet), Upwork, Fiverr, and LinkedIn ProFinder can connect you to new clients seeking short-term or one-off projects. These arrangements are ideal for filling gaps and building new relationships.

– Engaging in Networking Events and Conferences: Attending industry events, whether virtual or in-person, can connect you with potential clients and expand your network.

- Create Scalable Income Streams

Developing scalable income streams is another way to reduce dependency on specific clients. This could mean creating products or services that provide passive income or enable you to serve multiple clients at once. Examples include:

– Launching Online Courses or Ebooks: If you have a passion for helping other freelancers grow and have the expertise in a particular area to back it up, you can share your knowledge with others by creating digital products and selling these products.

– Offering Group Workshops or Consulting Sessions: Rather than one-on-one work, group sessions can maximize your income while minimizing time spent.

– Building a Retainer Model: Offering retainer packages to smaller clients for ongoing services can create a more predictable income flow without overwhelming you.

- Diversify Your Service Offerings

Niching down is great and all, but it can also have its downsides. You see, when your services are too niche, you may be overly reliant on clients who require your specific skill. Studying the market to see what works and expanding your services to meet the needs of a broader client base can help you reach new markets and minimize the risk of client dependence. For example:

– If You’re a Copywriter, Add Content Strategy: Offering content strategy services to complement writing can attract clients who need a more comprehensive solution.

– If You’re a Web Developer, Add UX Consulting: Combining web development with UX consulting can appeal to clients seeking not just technical development but a better user experience.

- Establish a Lead Generation Routine

To maintain a steady flow of new clients, establish a regular lead generation routine. This may involve setting aside time weekly for outreach activities, updating your portfolio, or following up with previous clients. By treating lead generation as an ongoing task (and not something you do when you need projects urgently), you reduce the chances of becoming overly reliant on existing clients.

- Nurture Client Relationships without Dependence

When diversifying, maintain good relationships with current clients, but avoid overdependence. Check in with them periodically, offer relevant updates or services, and remain proactive in seeking feedback. Balancing positive relationships with a proactive client acquisition strategy lets you retain clients without putting all your eggs in one basket.

- Prepare for Rainy Days

To minimize the financial impact of losing a major client, it’s wise to build an emergency fund that covers at least three to six months of expenses. Having a financial buffer can reduce stress and give you the flexibility to seek new clients on your terms if a primary client relationship ends abruptly.

Embrace the Shift: Benefits of a Diverse Client Base

While the transition from client dependence to a diversified portfolio will take time and intentional effort, the benefits are significant. With a larger client base, you’ll enjoy greater financial security, more diverse work, and an enhanced reputation as a well-rounded professional.

With time, your ability to balance multiple clients can lead to increased referrals, financial security, and the flexibility to pick projects that align best with your values and goals.

Conclusion: Building a Future-Proof Business

For freelancers and service providers, achieving a balanced client portfolio isn’t just about minimizing risk—it’s about building a sustainable and fulfilling business.

This is why it is crucial to see the challenge of client diversification as a path to growth and security and transform your business into one that thrives independently, regardless of the status of any single client.